Copilot is an app I was introduced to by one of my favorite podcasts, ChooseFI. It is extremely user-friendly and has pretty much every feature you can imagine in a budgeting app. You can track all of your accounts (and I mean all). I have it linked to my credit cards, checking account, savings account, Venmo, 401k through my employer, investment accounts, and even my student and car loans. For physician assistant students and especially new graduate physician assistants I can’t emphasize enough how important it is to track your finances and know where your money is going. Don’t be like me and spend willy-nilly every time you get those first big girl paychecks. If I had started tracking my expenses sooner I would have saved SO much money in the long run.

When I first started learning about finances a couple of years out of PA school I knew it was important to track my expenses to maintain a budget. Before I knew about Copilot I would type into the notes app on my iPhone every single time a penny left my account or wallet. At the end of every week, I would then total up all the categories (ie housing, groceries, restaurants, travel, etc.). It would probably take 15-30 minutes every weekend to do this. Not to mention the inconvenience of pulling my phone out every time I swiped my card. When I finally decided to try a free 2-month trial of Copilot I instantly regretted not signing up sooner. It was such a time saver.

I am going to break down exactly how I track my expenses and investments in Copilot, and why even with the annual fee it is worth its price.

Copilot Functions

Creates a budget

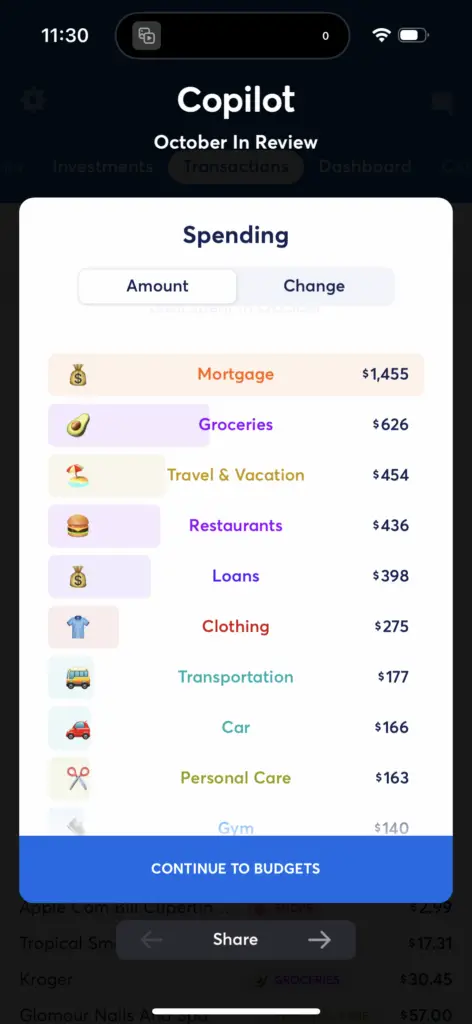

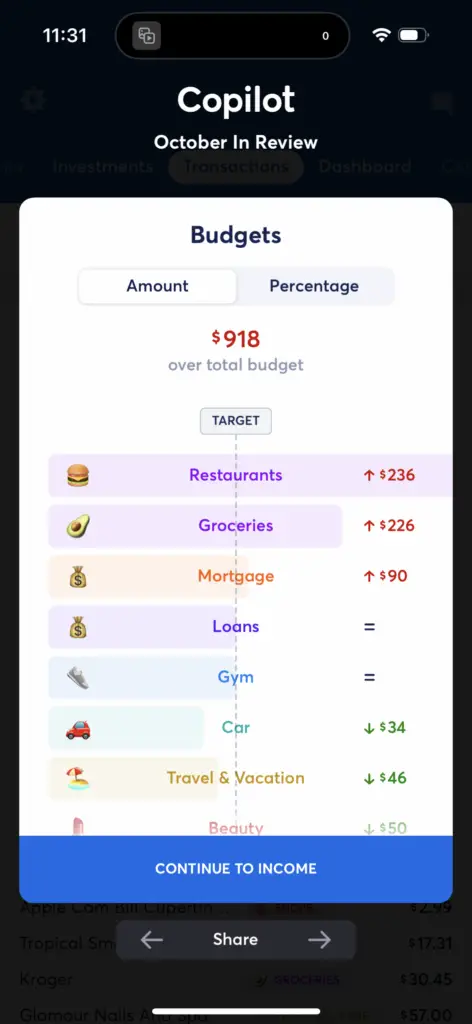

This is the main function of Copilot. When you first start using the app it will prompt you to create a budget for each category. There are many different pre-populated categories and you can even create your own. As you spend every day it will let you know where you are in your monthly budget. You can see this visually on your Dashboard tab or under the tab Categories. Copilot uses emojis and other visual aids to help you monitor everything. This helps you keep on track and not overspend. If you find yourself spending more in one category and less in another each month then you can choose to rebalance your budget. If you do this, the app will automatically make a new spending goal for each category based on your transaction history.

As you can see from the above photos I spent more than I intended on food for October. I group my utilities with my mortgage which is why my mortgage category amount was higher than previously budgeted. I did a few weekend trips in the month of October to visit friends, so I was over budget by quite a bit this month.

Tracks your accounts

As mentioned previously, you can automatically track all of your accounts in one place. Copilot uses Plaid to pull your data from other accounts. I have successfully been able to connect to all of my accounts, except my HYSA with American Express. I could probably reach out to their customer service to get this fixed, but since they have the option to track accounts manually I haven’t worried about it.

It’s so nice to no longer have to pull out my phone after I leave the grocery store to track how much I spent. Copilot will track which credit card I used and how much. It will even show you what percentage of your credit card limit you are at. My 401k updates automatically every time my paycheck comes through. Perhaps best of all I was able to watch my net worth increase as my investments went up and my student loans dwindled down to zero.

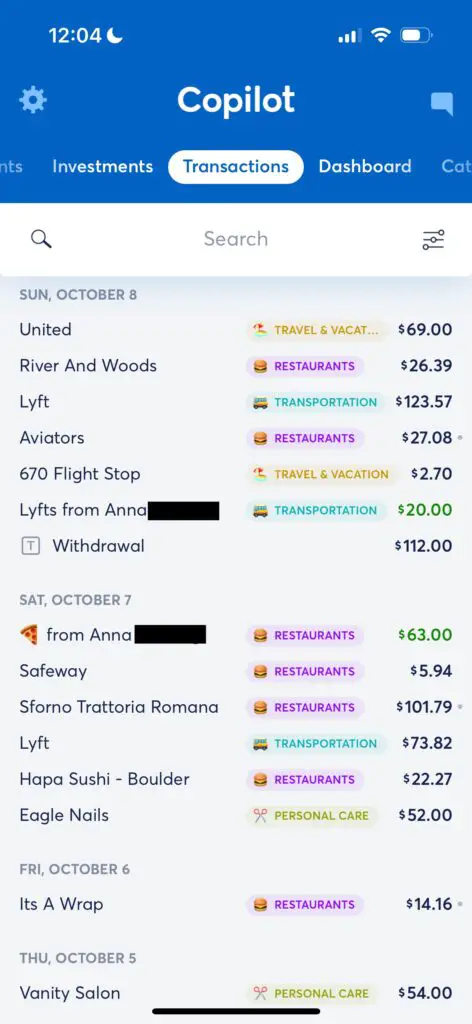

Automatically categorizes your transactions

When you first start using Copilot there is a little work on your end to begin with. While it can be overwhelming at first, I promise once you spend even just a few minutes in the “demo” section of the app you will get the hang of it. You have to go through all of the transactions your app pulls through and categorize them. For example, I categorize my favorite Starbucks drink (grande ice brown sugar shaken espresso) under the category “restaurants” and when I fill up my car at the Shell gas station near my neighborhood I choose to categorize that under “car”. Once Copilot has all of this information it will make an informed guess as to which category each of your transactions falls under going forward. Every day I log in to review my transactions. If the category isn’t correct I can easily change it.

Here is an example of Copilot categorizing all of my transactions. (I had a long Lyft ride from the airport to my Airbnb.)

Why I think it is a good tool for new physician assistants

There is a psychology behind spending. It is good practice to start budgeting and tracking your money. The sooner the better. If you understand where your money is going every month then you will start to see a trend in where you are spending and what you are prioritizing. It will help you make smarter decisions on what to do with that well-earned paycheck. You should aim to keep your spending low and your saving rate high especially right out of school as new physician assistants. This can allow you to pay off your student loans quickly and start investing early. The earlier you start investing the more wealth you will be able to accumulate over your lifetime with compound interest on your side. Believe me when you can see your assets begin to rise and your amount of debt start to decrease you will be hooked.

If you are new to finances and all of this seems a little overwhelming then read this first: The 6 Things Physician Assistants Should Be Doing Right Now to Improve Their Finances.

The cost

I was able to sign up for a free 2-month trial. After that, I paid the hefty fee of $69.99 for the year. This comes out to $5.83 per month. Given the amount of time I spent doing all of this manually before downloading the app it was well worth the cost. I truly believe it has helped me not only save money but also invest more. Watching my net worth rise is quite frankly addicting. It’s almost like a game. I have been using Copilot for 6 months now and I will definitely be renewing for another year when the time comes.

How to try it for free!

If you are also interested in trying out Copilot for free for 2 months you can use my referral code: QNCT73

View comments

+ Leave a comment